[ad_1]

A significant story around the previous two decades has been the rise in dwelling prices. There are lots of variables at play. Limited offer is a person. An inflow of folks shifting to far more appealing spots is an additional. But rising fascination premiums are threatening to stymie the housing market. There are even fears that some of the current gains could be reversed.

That has pushed residence advancement shops Home Depot (High definition -1.98%) and Lowe’s (Reduced -2.01%) very well under the highs they reached at the finish of last year. But those people fears might be offering investors an chance. Is one particular of them improved than the other? Wall Road thinks so. And these charts clearly show why.

Graphic resource: Getty Images.

A single is often more highly-priced than the other

For the earlier ten years, Wall Avenue has been inclined to shell out a better valuation for Property Depot than for Lowe’s. As the valuation of the general stock market place oscillated, the two house enhancement outlets did a dance of amazing predictability. Resembling poles of two magnets repelling each other, the price tag-to-product sales ratios retained their length.

High definition PS Ratio knowledge by YCharts

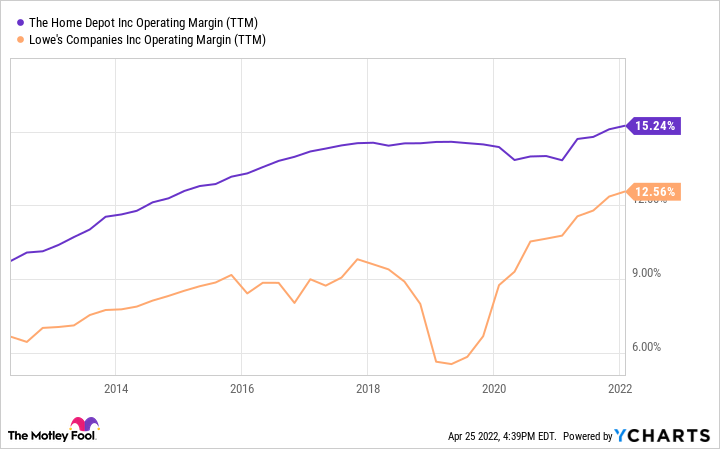

It truly is also persistently much more financially rewarding

One superior clarification is Property Depot’s profitability. Over that ten years, its running margin stayed at least one particular-fifth better than that of Lowe’s. The enterprise not too long ago warned that gain margins would undergo as expenditures surge.

Management went so much as to constitution its very own cargo ship to stay clear of the snarled worldwide provide chain. Historically, Lowe’s has put in additional on fees like income, internet marketing, and administrative capabilities such as human assets and accounting. In 2021, the variance was about a minor far more than 2% of profits — about the hole in functioning margin.

High definition Operating Margin (TTM) data by YCharts

In sharp distinction to heritage, the modern update at Lowe’s was optimistic. In February it elevated its complete-calendar year estimates for profits and earnings.

And it is really in a improved place to regulate its debt

One particular place where by Lowe’s appears more attractive is the volume of financial debt it carries when compared to House Depot. It has $30 billion in combined quick- and prolonged-time period debt on its harmony sheet. Dwelling Depot has $45 billion.

But digging a minor deeper reveals that Residence Depot is in a much better economic place, due to the fact it generates almost 2 times the earnings just before desire and taxes (EBIT). That signifies its moments interest attained ratio — the quantity of moments the EBIT can address yearly desire payments — is a lot higher.

Very low Occasions Interest Gained (TTM) facts by YCharts

It has grown faster, far too

All of this neglects the a single metric several investors prioritize above all many others: advancement. Here also, House Depot wins. Neither company is in hypergrowth method, and each benefited a ton during the pandemic from consumers’ willingness to invest on housing. But over the earlier 5- and 10-yr periods, the major line at Loew’s has expanded at a slower pace.

High definition Profits (TTM) knowledge by YCharts

Which a single pays you more to own shares?

Investors may well assume Lowe’s to make up for these perceived shortfalls by paying a larger dividend to shareholders. They would be incorrect. Household Depot’s distribution much exceeds that of Lowe’s. It has for most of the previous decade.

High definition Dividend Generate knowledge by YCharts

That does not account for all of the strategies to return capital to shareholders. Lowe’s has carried out appreciably far more stock buybacks in the previous handful of yrs. In actuality, it has repurchased 17% of shares excellent in just the previous three several years. Dwelling Depot has purchased back again just 6%.

Lowe’s also has much more area to maximize the dividend in the potential. It sends less than one-quarter of revenue again to shareholders as dividends. For Dwelling Depot, the selection is about four-fifths. Still, equally can quickly do it for the foreseeable potential.

Is the shifting of the guard near?

If you might be wanting to increase a person of the huge-box residence enhancement shops to your portfolio, the historical metrics make a persuasive case for Residence Depot over Lowe’s. But that could be switching. Differing 2022 outlooks and an aggressive buyback software have Lowe’s looking and sounding like the outdated Household Depot that Wall Street fell in love with.

Each supply investors exposure to an marketplace at the heart of the American economy. With robust cash return courses, good margins, and manageable personal debt, there is no improper decision. But Residence Depot has proved it can execute in excess of time. That is why I would lean toward it if compelled to decide on. Of study course, you will find no rule against purchasing the two.

[ad_2]

Source hyperlink

More Stories

Love Notes on the Wind, I Love To Walk the Land (2 Poems)

Renters – Pretend You Own It

Real Estate Investing Advice For Getting Rich