[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Steven Chrysosferidis as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

NicolasMcComber/iStock Unreleased via Getty Images

I believe that Home Depot (NYSE:HD) has a well-established position in the home improvement market. It’s augmented by a wide moat and an effective business strategy that will continue to allow the company to outperform the broader market if purchased at the right value.

The Home Depot is a globally renown and heavyweight firm in the home improvement store industry. They have a powerful brand, a strong fundamental performance, and have outperformed the market since 2006 – showing a 642.7% return vs. the S&P of approximately 250% (Figure 1).

Figure 1. Home Depot vs. S&P 500 (TIKR Terminal)

Home Depot is a long-term prospect for my portfolio and the ideal purchase price derived from my assumptions is a targeted entry point for building a position. When assessing Home Depot, I have separated the analysis into answering the following questions to establish a more in-depth understanding of the firm, contingencies, and fair purchase price.

Questions for discussion:

- How is the firm’s brand and reputation?

- Does the firm have an operational competitive advantage?

- Is the business strategy of the firm sustainable and are the shareholder’s goals aligned appropriately?

- What potential contingencies can I manifest and can the firm emerge through those successfully?

- What is the current fair value of the firm and what is my purchase price factoring in a margin of safety?

Brand and Reputation

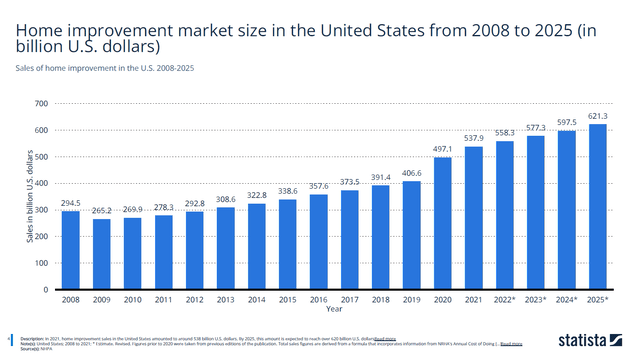

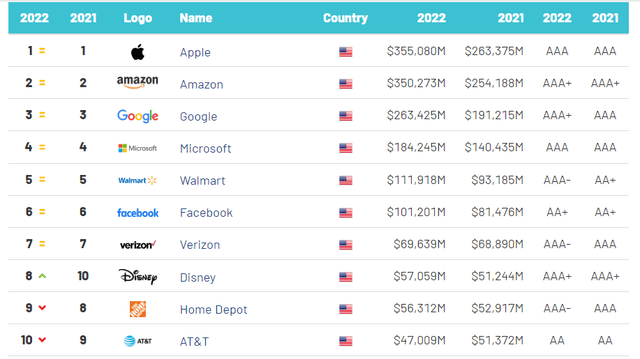

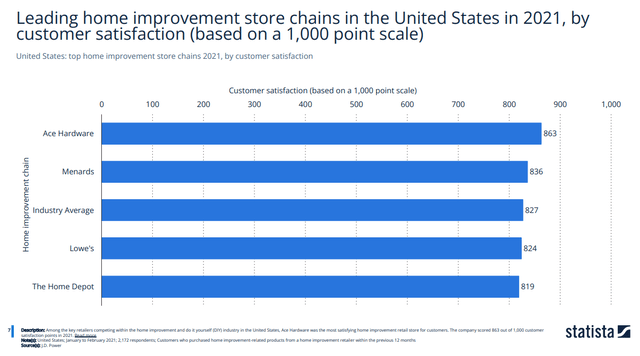

Home Depot is known as the world’s largest home improvement retailer and offers its products and services in accordance with that title. They operate in the home improvement market, which had a market size of $537.9 billion in 2021 with Home Depot capturing around 28.1% of that with their $151.16 billion in revenue (Figure 2). Home Depot has a powerful Brand name and is ranked as the ninth most valuable U.S. brand in 2022 (Figure 3). For perspective, they are in between Disney (DIS) and AT&T (T) ranked 8th and 10th, respectively. However, their customer satisfaction reputation could use improvement. Information from Figure 4 shows a lower customer satisfaction rating (819) in 2021 in comparison to the industry average (827), while firms such as Ace Hardware (863), Menards (836), and even Lowe’s (LOW) (824) showed a higher rating. Home Depot has a well-positioned brand based off its U.S. reputation. The underperformance in customer satisfaction to their industry is notable, though, and needs to be aggressively improved for future performance to help increase market share and expand their competitive advantage.

Figure 2. Home improvement market size in the United States (Statista)

Figure 3. US 500 2022 (Brand Finance)

Figure 4. Leading home improvement chains in the United States (Statista)

Competitive Advantage

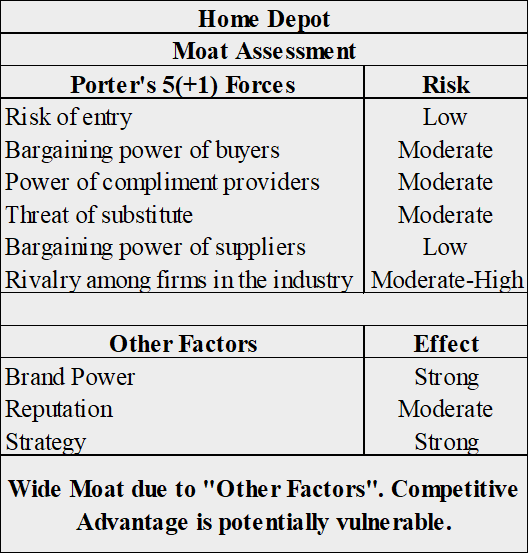

The best attempt to understanding the competitive advantage of Home Depot is to assess its current position in its market using Porter’s 5(+1) Forces. The six variables to be considered are as follows: 1) risk of new entries, 2) bargaining power of consumers, 3) power of complement providers, 4) threat of substitutes, 5) bargaining power of suppliers, and 6) rivalry among firms in industry.

Risk of entry

The Home Improvement Store industry is a mature industry and is highly fragmented with pockets of stronger competitors like Home Depot, Lowe’s, and Menards. The demand for the industry services and products is expected to grow at a mature rate so new competitors are not overly incentivized to enter. Home Depot is attempting to offer products and services to 90% of the U.S. population with a minimum of two-day delivery. This technology and logistical component would discourage smaller home improvement stores on a local level from opening, while also placing low-cost pressure on pre-existing stores. There are minimal barriers to entry regarding patents or legal restrictions for newcomers.

According to IBIS world, the annualized growth of firms in the home industry when ranked against other industries is low concluding that there is little incentive for firms to disrupt Home Depot’s market. The brand loyalty of current home improvement firms increases the barriers for potential new entrants as well. The overall risk of entry is low for firms disrupting Home Depot without an innovative catalyst for doing so.

Bargaining Power of Buyers

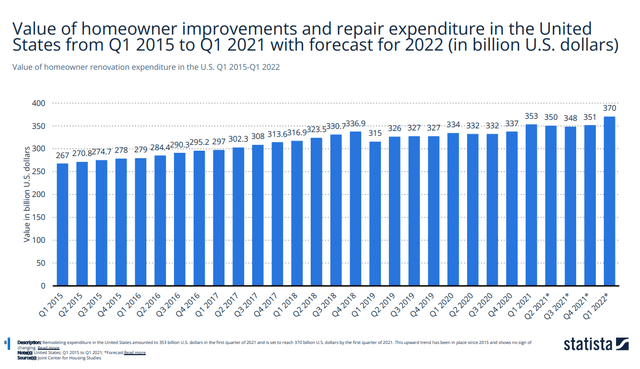

Home Depot’s customers can be broken into two categories, do-it-yourself (DIY) consumers and professionals (pro). The pros make up 2-3% of the customer base but account for 40-50% of the revenue. The value of homeowner improvements has been trending in a positive direction since 2015 (Figure 5). The customers bargaining power for Home Depot is driven by the competitive landscape. While Home Depot is a low-cost provider and has a strong brand, they only have pricing power to a threshold before consumers are willing to find other choices in the competition. Buyers do have slight negotiating power at Home Depot’s stores for large purchases or imperfections. There are minimal switching costs for customers to utilize different firms for their products or services except small incentives like membership rewards. Fortunately for Home Depot, their technology and business strategy allow them to be one of the lowest-cost providers, thus mitigating the weight of customers’ bargaining power, which reduces the overall competitive risk to moderate.

Figure 5. Value of homeowner improvements and repair expenditures in the U.S. (Statista)

Power of Complement Providers

A complement provider is a product or service that derives value from creating more products and services from it. Home Depot is a complement provider because their products create demand for more of their products. An example is a power drill where the initial purchase is a one-time purchase of the basic drill and battery pack with an attachment drill bit. This customer will partake in projects that need screws, holes bored, different drill bits, extra batteries, etc. This is a powerful force for creating future demand. Home Depot is at a moderate risk level from their complement products because they are not the exclusive providers for the complement products, but they do offer enough product variety at competitive pricing to help alleviate these pressures.

Threat of Substitute

Home Depot’s products are moderately substitutable. The typical customer who makes purchases from Home Depot is cost-conscious since they are typically working on a budget or specific time frame. A substantial percentage of the purchases are not mandatory for the day-to-day livelihood of the customers, so they could substitute the products with other products if necessary. An example of this for Home Depot would be if the price of lumber for framing is excessive, then a customer may opt to purchase stone, brick, or steel products instead depending on their assessment of the utility and cost. Fortunately for Home Depot, they do sell substitutable products and are not over-specialized in their offerings. Home Depot gets a moderate risk for substitution since the price is dictated by more variables than they can control while they mitigate its effects by having competitive costs and product variety.

Bargaining Power of Suppliers

Home Depot has strong leverage when it comes to suppliers due to their economies of scale and volume of suppliers. Unfortunately, there are likely exclusive suppliers who have a competitive advantage, and the suppliers are also highly susceptible to the cost of materials that they are having to deal with which passes those costs onto Home Depot. Home Depot does have the ability to backward integrate into their suppliers’ domains, making in-house brands that better contribute to their margins overall and alleviating some supplier concerns. Home Depot does maintain a focused relationship with their suppliers which encourages the continuity of their businesses. The risk from suppliers’ bargaining power is low since Home Depot is well positioned to maintain those relationships.

Rivalry Among Firms in the Industry

Rivalry among firms in this industry is competitive and going to continue to increase as technology and more efficient logistical chains create new opportunities for growth. The high amount of fixed costs associated with owning the space and inventory disincentives competitors. The potential in the future for a technological & logistical remaking of home improvement products and delivery methods does pose as an opportunity for large firms like Walmart (WMT) and Amazon (AMZN) to continue to compete in the space and encroach on market share by using technology and economies of scale. This may be limited in some capacity by the size, weight, and volume of products that Home Depot’s consumers often need to purchase.

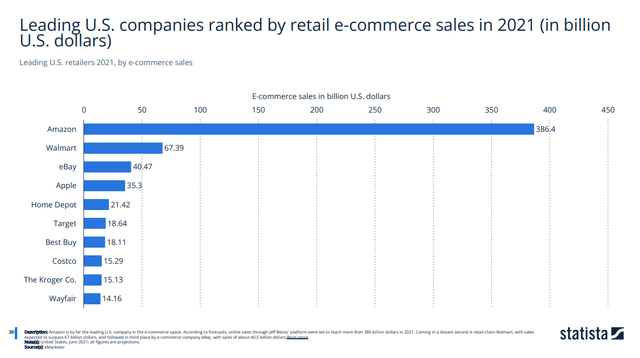

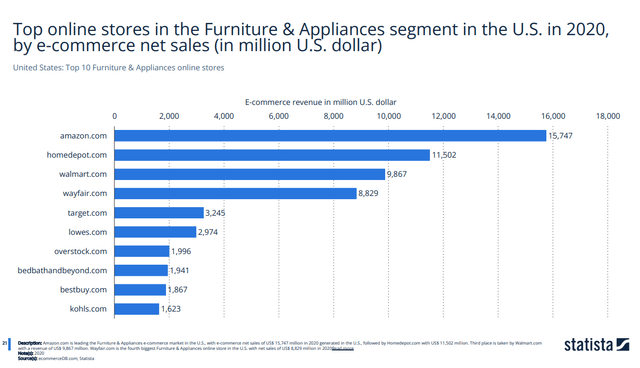

Home Depot is aggressively increasing their e-commerce sales while holding the fifth largest U.S. retail e-commerce sales position in 2021 (Figure 6) and having the second largest sales online in furniture and appliances in 2020 (Figure 7). Given the potential in the future for competition to encroach while also considering the life cycle of the firm, the risk is moderate to high for Home Depot with rivalry among firms in the industry.

Figure 6. Leading U.S. companies ranked by retail e-commerce sales in 2021 (Statista) Figure 7. Top online stores in the furniture & appliances segment in the U.S. (Statista)

Business Strategy

Home Depot operates in accordance with the following three goals:

-

We intend to provide the best customer experience in home improvement.

-

We intend to extend our position as the low-cost provider in home improvement.

-

We intend to be the most efficient investor of capital in home improvement.

Their plan to deliver on creating shareholder value is through a disciplined approach to capital allocation (as per the previous link):

-

We intend to reinvest in our business to drive growth faster than the market.

-

After meeting the needs of the business, we look to return excess cash to shareholders through dividends and share repurchases. We intend to increase our dividend as we grow earnings.

The strategies are simple, well-defined, and focused. This builds confidence as an investor and eases the burden of overcomplicated assumptions and unpredictable outcomes. Home Depot is currently lacking in their customer experience in comparison to their industry. This represents their weakest execution of their current strategy. They are highly competitive and a leader in being a low-cost provider. When compared to Lowe’s, they have certain relative comparisons that are better than their immediate competitor.

For example, Home Depot has a better net margin when compared to Lowe’s (10.83% vs. 8.85%, respectively), a better net income per employee ($33,671 vs. $28,180, respectively), and a higher ROIC in 2021 (44.7% vs. 35.3%, respectively). It is important to note Home Depot did lack in other metrics and trades at a premium to Lowe’s according to relative multiples.

Their primary plan to reinvest in the business to drive growth is obviously well aligned with shareholders. They are moving heavily into their online presence to help unlock the value and market share in the ever-changing consumer dynamic. Dividends and share repurchase once the business fulfills all growth requirements are also well aligned for shareholders. Home Depot has been growing their dividend with a 3-year growth rate of 15.46%, which outperforms the sector median of 7.72%. They returned $15 billion in share repurchases from 2019 to 2021 and authorized $20 billion in May 2021 (of which $9.6 billion remains as of January 2022).

Home Depot’s strategy is simple and achievable while maintaining the shareholders’ interests going forward. Figure 8 shows the summary of Home Depot’s moat and other key factors as discussed. I do think that their vulnerabilities could be exposed if the leadership loses perspective on the firm’s core values such as in customer satisfaction, unpredictable technology innovation increases competitor pressure, or a large dominant player that decides to leverage their firm’s synergies encroaches into Home Depot’s market. Overall, I have deduced that there is a wide moat that is well supported by competitive strengths which are augmented by their brand, strategy, and reputation.

Home Depot Moat Assessment

Potential Outcomes and Assumptions

For this forecasting, Home Depot has been separated into three modeling states (pessimistic, expected, and optimistic); all models are based on my results and assumptions. Factoring in the the current macro environment, historical performance, Home Depot’s business model, and competitive advantage have resulted in the future predictions to assume each state’s weight.

Home Depot’s key external drivers were identified as 1) disposable income per household, 2) housing construction spending, 3) current inventory of households, and 4) inflation. Data from the Federal Reserve Economic Data (FRED) was then used to compare the compounded growth rates and observe similarities between 2007 and 2022 to identify Home Depot’s potential outcomes. Focus was directed more on pessimistic outcomes to build a margin of safety into calculations. The assumptions below are observational and correlational analysis has not been conducted statistically.

Disposable Income per household in March 2007 was at $11,475 vs. $15,309 in March of 2022 (Figure 9). This equates to a CAGR of 1.94%. This did not outpace the CAGR of inflation for the same period of 2.27%, so there is technically less disposable income per household than across the time horizon. This shows that the household is at a higher risk to not make retail purchases outside of necessity in comparison to the past.

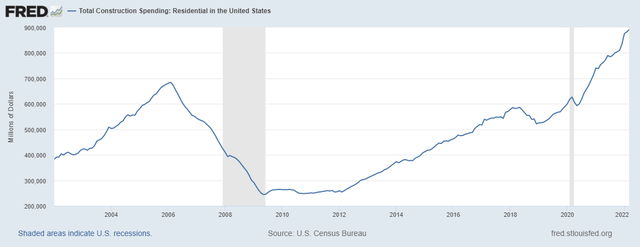

Figure 9. Real disposable personal income (Federal Reserve Economic Data)

Total residential construction spending from March 2007 to March 2022 was $534,635 million versus $891,280 million, which indicates a CAGR of 3.47% (Figure 10). Another interesting component in this chart is the large decline in spending from approximately $700,000 million to $250,000 million from 2006 to 2009. Those involved with the construction industry in 2008 and 2009 experienced how poorly the industry performed during this period. Noting the relationship between total construction spending decrease and Home Depot’s revenue decrease is interesting because Home Depot’s revenue (Figure 13) was a lagging indicator due to reporting timing when its revenue decreased from 2007 to 2010. The current residential construction spending does support growth prospects for Home Depot moving into the future since the growth rate has outpaced inflation.

Figure 10. Total construction spending (Federal Reserve Economic Data)

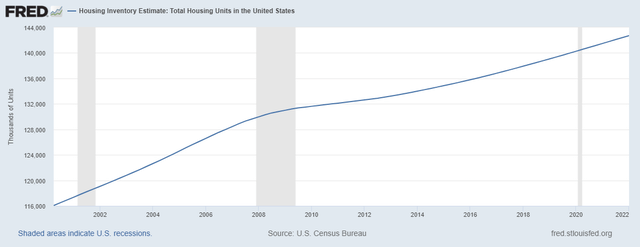

The current inventory of households has increased from 128,439 thousand to 142,711 thousand between March 2007 and March 2022 (Figure 11). This represents a CAGR of 0.7%. It is a good indicator when the number of households increases because the likelihood that homeowners will have to spend on home improvement also increases, creating more demand within Home Depot’s market.

Figure 11. Housing inventory estimate (Federal Reserve Economic Data)

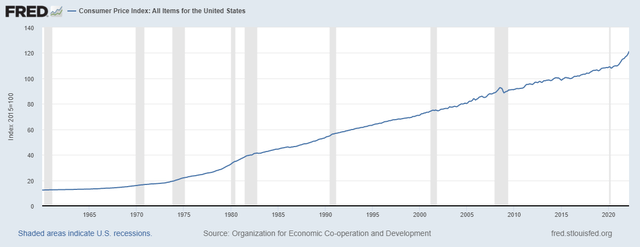

Inflation is a powerful value destroyer (Figure 12) below shows that the CPI CAGR from March 2007 to March 2022 is 2.27%. The current high rates if left unchecked will continue to have an impact on Home Depot’s margins and consumers’ purchasing power. Since inflation is so prevalent and rampant in our current macro environment, the assumptions for Home Depot are going to be more heavily weighted toward a pessimistic scenario accordingly.

Figure 12. Consumer price index (Federal Reserve Economic Data)

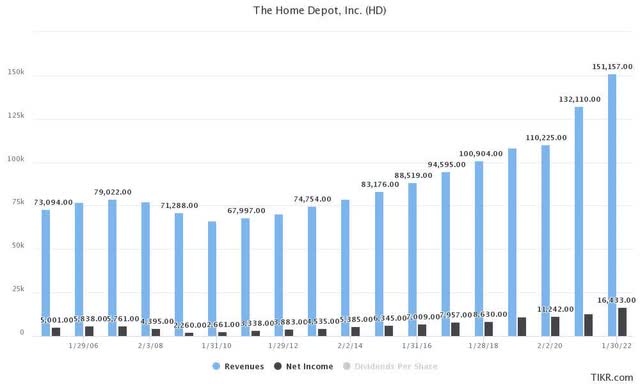

Reviewing Home Depot’s revenue and net income between 2005 and 2022 should help portray a reasonable expectation in the case of pessimistic assumptions (Figure 13). From 2007 to 2010 Home Depot showed a decrease in revenue from $79,022 billion to $66,176 billion (CAGR of -6.09%) over three annual periods. The minimal revenue decrease is a great signal and shows resiliency in customer sales for Home Depot even when macro economics are directly affecting the drivers of the business. The net income decreased by 48.58% from 2008 to 2009, which is a substantial drop that led to decreasing share price during the same period. These events could have been catastrophic in the short term; however, Home Depot regained their footing within a reasonable period and continued to perform, highlighting their business model, brand, and competitive advantage.

Figure 13. Revenue & net income (TIKR Terminal)

Valuation

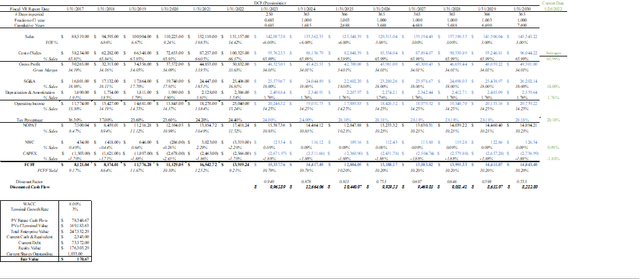

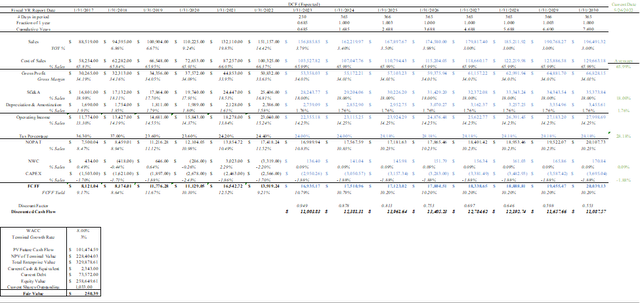

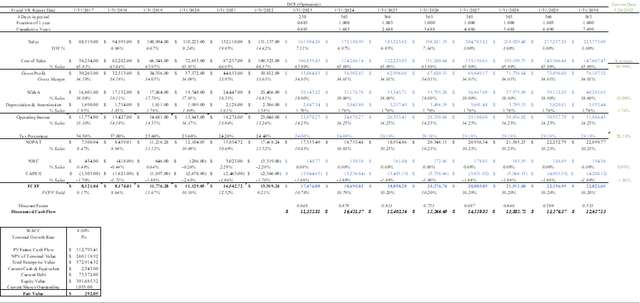

The purchase price for Home Depot was determined by developing a DCF model for each potential assumption state and weighing them to actualize a potential purchase price as shown below. The model reconstructed the relevant portions of the income statement at the average between 2018 and 2022 for each line item. The averages were then used to forecast the future performance of Home Depot. The FCFF was derived and then discounted accordingly to realize the present value of the firm. The terminal value was also derived at a 3% growth rate in perpetuity and discounted back appropriately. The values were all discounted by a WACC of 8%. The discounted values were then added to determine the enterprise value of the firm. Debt was then subtracted from the enterprise value and the cash was added to determine the equity value. Equity value was then divided by the current shares outstanding to result in the fair value of that state.

Pessimistic state (Figure 14): This state was weighted as a 40% probability due to current macro-economic fears and Home Depot’s reliance on the key drivers as explained earlier. A negative 6% growth rate was assigned for 3 years followed by a perpetuity of 3% growth.

Expected State (Figure 15): This state was weighted as a 30% probability. Home Depot is a strong and resilient business, and it is likely they will continue to perform well into the conceivable future. The revenue input will use Home Improvement Market Growth Rate (Figure 2) through 2025 and assume that Home Depot maintains their market share percentage consistently. A perpetuity of 3% growth will be maintained after that.

Optimistic State (Figure 16): This state is weighed as a 30% probability. Home Depot has outperformed the market by being adaptable in a mature industry with changing technology and using financial engineering and shareholder incentives to show its stability and positive direction. The Home Improvement Market Growth Rate will be used (Figure 2) through 2025 and assuming a multi-percentage increase in market capture year-over-year. A perpetuity of 3% growth will be maintained after that.

Figure 14. Scenario 1 DCF

Figure 15. Scenario 2 DCF

Figure 16. Scenario 3 DCF

Risk

Home Depot is particularly susceptible to macro-economic risks like inflation, consumer spending, and the construction industry. Home Depot’s competitive advantage could be specifically targeted from other large firms through technological innovation or by using their established businesses synergistically. Any of these variables could alter the revenue and market share estimates modeled. Home Depot is also exposed to internal business risk through margins potentially being diminished at different levels through line items increases like inflationary supply costs or large salary increases for employees. These pressures internally and externally could alter the valuation significantly. If the whole market continues to underperform and Home Depot expresses resiliency, then Home Depot may shift to a “buy” rating. If Home Depot becomes a victim of the macro environment and the effect is greater than the modeled effect, then the current “hold” rating should be maintained. If Home Depot’s competitive advantage changes significantly, the business should be reassessed to determine if there is a change in their rating.

Conclusion

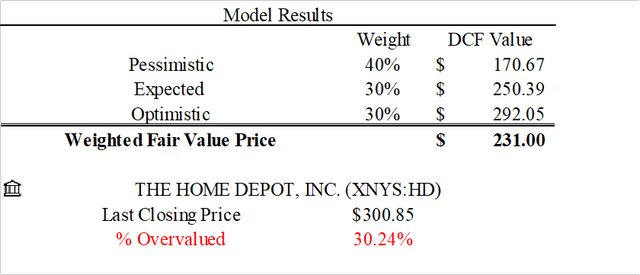

According to the model results (Figure 17), the three assumption states formulated fair values of $170.67, $250.39, and $292.05 per share, respectively. The weighted calculation provided a goal purchase price of $231 per share. The last closing price as of this writing was $300.85, which shows that Home Depot is currently overpriced; however, future market conditions may provide advantageous entrance positions considering industry position and the overall strength of the company.

Figure 17. Valuation Summary

[ad_2]

Source link

More Stories

Spending Equals Investing

Vietnam – The Land That Time Forgot, But I Haven’t

Boost Your Retirement Through Investing Into Cryptocurrency