[ad_1]

Douglas Rissing/iStock by using Getty Photos

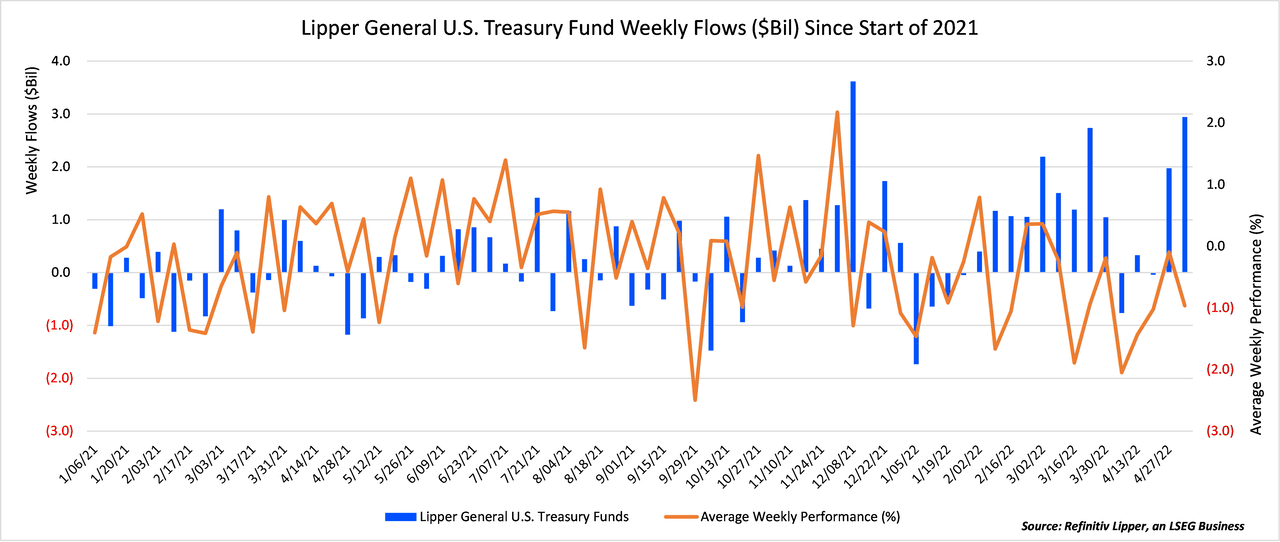

The Lipper Common U.S. Treasury Cash classification consists of cash that make investments mostly in U.S. Treasury payments, notes, and bonds. The resources inside this classification had an common duration of 12.2 years as of December 2021.

When compared to other major fastened earnings indices like the Bloomberg Municipal Bond Total Return Index (-8.8%) and the Bloomberg U.S. Aggregate Bond Total Return Index (-9.5%), Lipper Basic U.S. Treasury Resources have posted a incredibly underwhelming year-to-day efficiency by way of April thirty day period conclusion of destructive 13.3%.

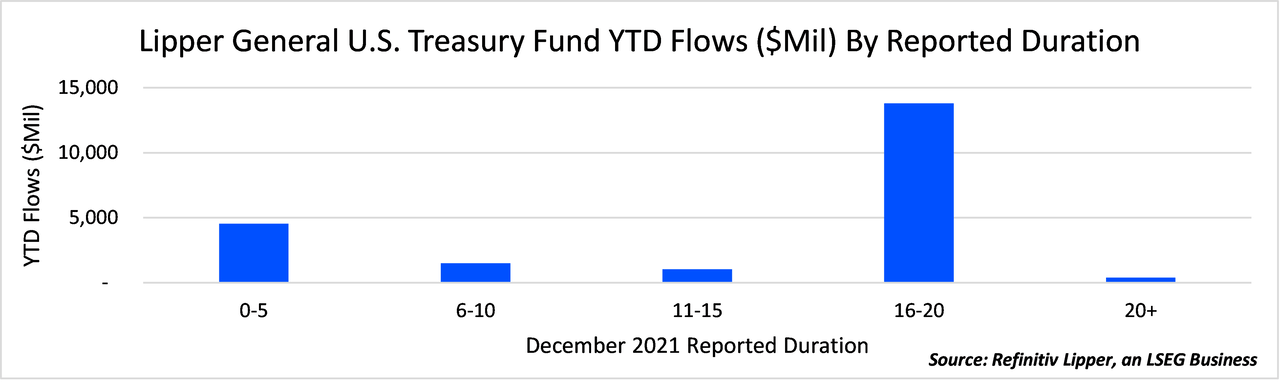

Inspite of the bad comparative functionality, the classification led the way this previous fund flows week, attracting $3. billion. Lipper Normal U.S. Treasury Cash have also been red hot given that the start off of the 12 months, pulling in $21.4 billion, generating them the third most popular Lipper classification in that span – powering only Lipper Worldwide Money Resources (+$33.4 billion) and Lipper Mortgage Participation Funds (+$25.2 billion). Lipper Common U.S. Treasury Money also established a quarterly intake document through the fourth quarter of 2021 as they described inflows of $13.9 billion.

Lipper Standard US Treasury Funds (Creator) Lipper General US Treasury Fund Flows (Writer)

Wednesday, May well 4, the Federal Reserve policymakers decided they will raise rates by 50 foundation details (bps) for the to start with time in extra than 20 a long time. Though the significant hike was mostly envisioned, Federal Reserve Chair Jerome Powell pointed out that greater moves had been not in the Fed’s upcoming designs. It is still forecasted, nevertheless, that the Fed will elevate costs all through each individual of its remaining conferences this yr.

With the very poor general performance of for a longer period-dated Treasury bonds presently understood via April, inflationary fears rising, and the recent soaring premiums setting in place, the concern stands: Why have extended-dated U.S. Treasury Resources captivated so much funds this 7 days and this year?

To get the respond to we may perhaps will need to take a phase back. Equity marketplaces year-to-day by means of April have logged even even worse returns than Lipper U.S. Typical Treasury Resources – Nasdaq (-21.2%), Russell 2000 (-17.%), and S&P 500 (-13.3%).

The only U.S. wide-based mostly fairness index to outperform the classification was the DJIA (-9.25%). As curiosity prices increase, the significant-traveling, currently expensive advancement and engineering stocks are in for a tough experience. Principal defense, tax exemptions, and certain prices of return turn into even a lot more critical as the financial state appears to be heading towards turbulent situations.

Threat mitigation and diversification are two terms that have seemed to have come to be less pretty throughout the past bull industry. Goldman Sachs’ economic crew just very last thirty day period forecasted there is now a 35% possibility of a U.S. recession around the next two years.

Deutsche Bank, which initially published its economic downturn foundation situation as late 2023, has claimed a downturn by the finish of the calendar year is likely if the Fed proceeds its aggressive monetary tightening. In order to prevent significant drawdowns in a broader portfolio, an allocation to Treasuries functions as an possibility to diversify chance.

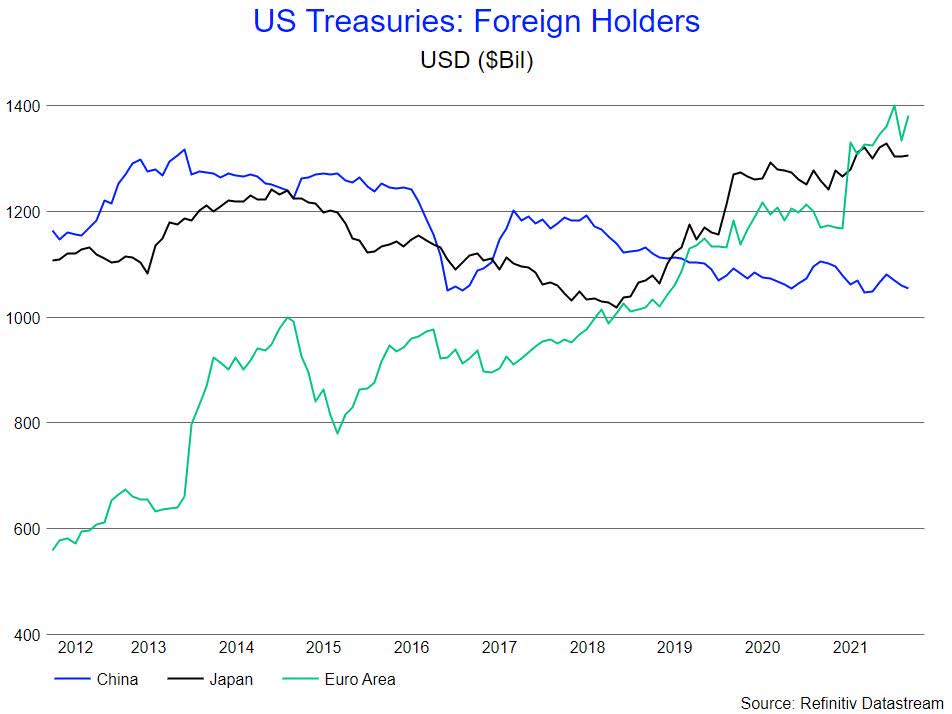

A third feasible professional of this Lipper classification in the presented natural environment is the actuality that market place members could possibly believe that today’s costs by now variable in the long term expectations of increasing fees. If that is the circumstance, and yields rise considerably less than expected, the situation for keeping for a longer period-expression bonds is a robust 1 – a stance numerous overseas traders are betting on.

US Treasuries (Author)

Editor’s Be aware: The summary bullets for this post had been picked out by Seeking Alpha editors.

[ad_2]

Source url

More Stories

How to Choose Between Elder Home Care Services and Nursing Homes

Are There Lizards in Myrtle Beach?

Understanding the Different Types of Personal Care Homes