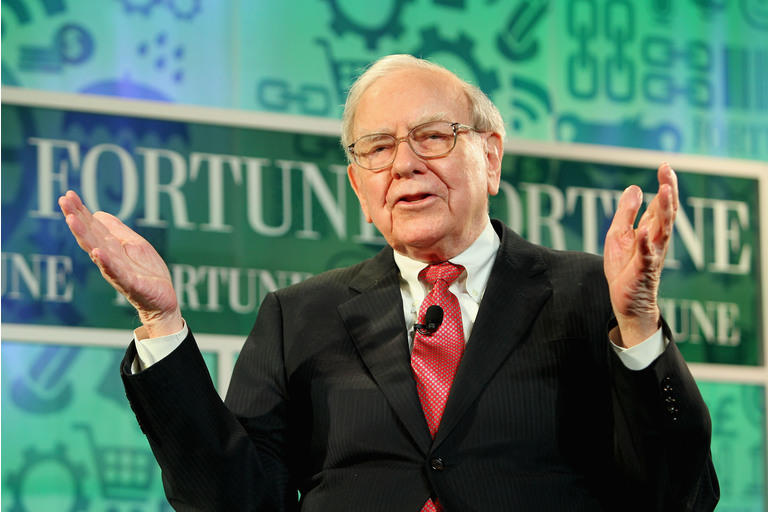

Warren Buffett is a person of the pretty couple of investors to have managed to compound returns at a 20% once-a-year ordinary for much more than 50 decades.

Anyone can do well above a 5-10 12 months time time period, but the true exam is whether you can retain likely for decade right after 10 years, and Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is one particular of the uncommon exceptions to have obtained that:

| Berkshire Hathaway | S&P 500 (SPY) | |

| Compounded Once-a-year – 1964-2020 | 20.% | 10.2% |

| In general Get – 1965-2020 | 2,810,526% | 23,454% |

So, when he talks, we listen.

In modern article, we look closer at his solution to serious estate investing. In excess of the a long time, he has frequently reviewed why he hardly ever purchases authentic estate, but far more recently, he has designed massive investments in the REIT sector (VNQ).

Underneath we spotlight 5 good reasons why Warren Buffett favors REITs above private home investments:

Reason #1: No Aggressive Advantage

In a shareholder meeting decades in the past, Warren Buffett explains that they are not outfitted to contend with buyers who specialize in real estate investing.

The attention-grabbing detail below is that again then Warren Buffett presently had invested tens of millions into genuine estate, had significant resources as a result of Berkshire, and Charlie experienced designed his initial fortune in actual estate.

Even then, they felt that they couldn’t compete with REITs and other LPs that specialised in serious estate investing and had an informational edge about them.

Listed here you should inquire you: If Warren and Charlie can not compete in the serious estate house, can you?

A good deal of individual traders believe that right after observing a several YouTube video clips and getting a real estate investing program from an online expert, they are nicely prepared to develop into actual estate traders.

In fact, most traders are overconfident and overestimate their qualities. Warren Buffett is quite practical about his constraints and understands that until you are 100% targeted on genuine estate, you are not likely to achieve excellent final results investing in it.

Cause #2: Lack of Mispricing

Fairly related to motive #1, if you are not totally devoted to authentic estate, you are not likely to obtain mispriced prospects.

Warren Buffett clarifies that mispricings in serious estate are scarce. The industry is somewhat effective at pricing threat simply because most traders are long-term oriented.

On the other hand, mispricings are much more recurrent in the stock market place simply because most traders are small-expression-oriented and brief to worry when they see their stock decline in benefit.

Warren thinks that if you are an energetic investor, you happen to be additional probable to discover better promotions in the inventory market, including REITs, than in non-public authentic estate.

That’s what he mentioned many years ago and it is perfectly mirrored in modern current market.

Right now, housing is red hot, and business serious estate is marketing at traditionally low cap fees. The costs reflect the extremely-small curiosity amount atmosphere that we dwell in.

Even then, the REIT marketplace is today severely mispriced. Several REITs, which includes blue-chip names like W.P. Carey (WPC), Realty Revenue (O), and Countrywide Retail (NNN) are down by 20-30% even as their fundamental homes are extra valuable than ever in advance of.

Which is a superior chance.

Cause #3: Corporate Tax Drawback

Berkshire Hathaway is structured as a corporation and it’s liable to company taxes.

Charlie and Warren demonstrate that this places them at a significant drawback relative to REITs, which are exempt from corporate taxes.

If you generate a 6% generate on a home, the REIT is remaining with 6%, but Berkshire is still left with a decrease revenue because of to taxes.

Even then, Berkshire has manufactured REIT investments, which are much more tax economical for the reason that REITs only shell out out 50%-70% of their dollars move in dividends, and the relaxation is retained at the REIT degree and not taxed. Furthermore, REITs have a increased expansion/appreciation part than non-public real estate, which effects in reduce corporate taxes.

Purpose #4: Administration And Scalability

In an interview for the duration of the fantastic money disaster, Warren Buffett describes that if he experienced a way to competently take care of serious estate, he would load up on one-family homes.

A good deal of buyers make the slip-up of assuming that authentic estate is a passive expenditure when in actuality it can be management intense.

You are working with the dreaded 3 Ts: Tenants, toilets, and trash.

Could Warren Buffett hire a residence administration enterprise? Guaranteed, he could. In truth, he would get a significantly superior offer than you or me if he did that.

On the other hand, the concern with assets administration providers is that their expenses consume into your profitability, but even additional importantly, their passions are not aligned with yours. Acquiring a assets and handing the keys to a home manager is the equal of acquiring an externally-managed REIT, which we all know, is seldom a good plan owing to conflicts of fascination.

With traditional REITs, Warren Buffett receives expert management which is perfectly aligned with shareholders and enjoys considerable economies of scale.

You also can easily deploy cash in a couple of clicks of a mouse, which will make it uncomplicated to scale your investments about time.

Explanation #5: Alternatives are in REITs Nowadays

Warren Buffett is a benefit trader.

He needs to acquire large-good quality property at a lower price to truthful benefit.

But as noted before, the personal real estate current market is presently pink hot. With the exception of a couple of challenged sectors (office, malls, etc.), you’re unlikely to come across discounted alternatives. The desire for personal genuine estate is bigger than ever ahead of thanks to the extremely-lower curiosity costs.

Even then, lots of REITs are today priced at historically low valuations, and not surprisingly, that’s what Warren is getting. Beneath we spotlight a single of his preferred REITs:

Retail store Funds

Berkshire Hathaway first purchased shares of Store Money (STOR) again in 2017, and recently, they doubled down.

As a final result, they now have almost 10% of the equity:

According to an interview of Chris Volk, CEO of Keep Cash, it is Warren Buffett that was driving this expense. You can skip to the 8:55 mark to master extra about Warren Buffett’s financial investment in Retail store:

What’s so unique about Store Capital?

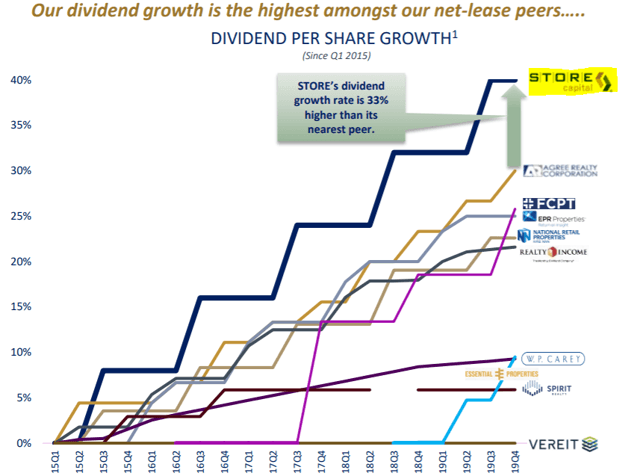

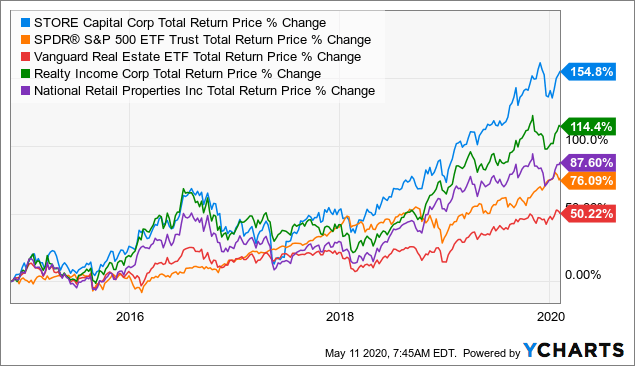

In small, STOR has a special tactic that generates greater returns with decrease chance than what Berkshire could obtain on its personal. We explore this tactic in depth in a independent post so we will not go into the aspects listed here, but its technique has persistently led to considerable outperformance relative to its shut peers, and this is probably to proceed far into the potential:

Even then, STOR has been priced at an extremely lower valuation more than the previous year. It truly is still ~15% reduced than prior to the pandemic, and that’s irrespective of climbing its dividend by 3% in 2020 and guiding for record-significant cash move in 2022.

You simply just are not able to locate this variety of prospect in the private actual estate market and which is why Warren Buffett favors REIT investments.

Right now, there are ~25 equivalent REIT possibilities in which we are investing at High Produce Landlord.

More Stories

What Are Provisional Sums and Prime Costs in a Home Building Contract?

Realtors Vs The We Buy Houses Cash Companies

Tax Gifts to Real Estate Owners